With health insurance costs through the roof, read on for ways to lower your premiums.

With health insurance costs through the roof, read on for ways to lower your premiums.

Mike came to see me, near tears. He’s had to pull money from what he’d hoped to save for his daughter’s college to cover his $1500/month family health insurance premiums now required under the Affordable Care Act (ACA).

Sarah was enraged—“I’m 23, very healthy, I work hard, my premium skyrocketed 78 percent in one year!”

Over a decade ago I had to get my own health insurance—I stepped off the corporate treadmill and again had my own family business. At that time, ObamaCare didn’t exist; there was no legal health insurance requirement, it just made sense to protect my family from the costs of fixing a catastrophic accident. None of us have any health problems and we make sure of that by eating right and staying active.

Working with an insurance broker, the best I could do (again, over a decade ago) was about $650/month for a plan through Blue Cross Blue Shield that came with a shocking (at that time) $5000 deductible. Despite my son’s ski racing and football, my climbing and adventure; we’ve never submitted a claim or met the deductible. Now I’m forced to have insurance to keep me healthy and avoid financial hardship—or so the law reads.

I thought the Affordable Care Act would give a healthy person like me a low-cost premium.

The ACA was supposed to make health care more affordable by pooling all US Citizens and spreading out risk. In 2010, my $650/month family premium was for us as self-employed business owners without corporate benefits (companies under 50 employees are not required to provide health insurance benefits). Not being pooled into big business’ mix of employees, many with health problems, shouldn’t my high (I consider it high) premium go down? After all, I take care of myself and am among the healthiest people I know.

Affordable. Adjective inexpensive; reasonably priced.

Using the nifty enrollment tool for the federal health insurance marketplace at www.healthcare.gov I learn:

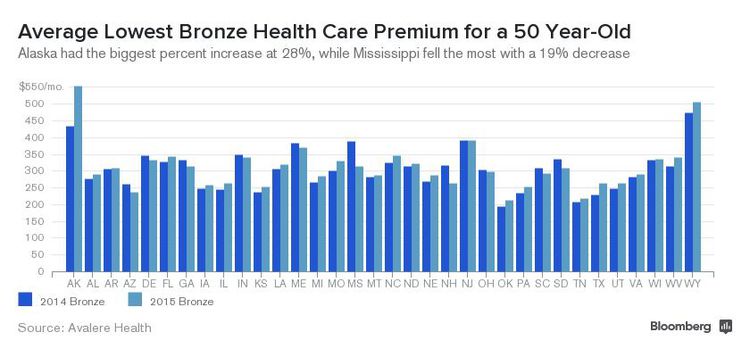

We Alaskans “can choose from among 34 plan options.” Wonderful! With that level of competition surely we’ll find plans that offer excellent benefits from the doctors we already see.

Except… individual (non-corporate) plans are available from just two medical insurance carriers: Premera Blue Cross Blue Shield of Alaska and Moda Health (formerly ODS Health Systems of Oregon). But yay! My doctor is on the Blue Cross Blue Shield insurance products. Continuing on…

I plug in my info, my husband’s info, my 16-year-old’s info… hit the Search Plans button and…

Heart attack!

My affordable care is with the Moda plan where I’ll have to switch doctors. “Affordable” means I’m going to pay almost as much as our mortgage each month: $1981/month for a $10,500 deductible! Of course once we meet that deductible Moda generously picks up 70% of our covered expenses (I can hardly wait to see what’s covered). The Premera plan with a $12,000 deductible is $2250/month.

Yikes! So much for my gym membership, buying the pricier organic foods… no matter, my prescription drugs are covered (sarcasm).

We don’t smoke, drink, we eat healthy and stay fit, I’m not having any more children at 58… in short, we’ll be paying $21,376 in annual premiums plus the first $10,500 out of pocket for a whopping $31,876 every year for… I’m not sure for what since I have to be diagnosed with a health problem before any benefits kick in and the natural and drug free health care services I believe in are not covered or extremely limited.

My wellness has been my health insurance and still is.

So much for saving for my son’s college, for my next credential, for… I could cry. I did cry.

But “the high cost is justified” all the insurance and government websites claim: Insurance plans are mandated to cover more (maternity for everyone—including my 58-year-young female self; vision check-ups—that soaks up $150 for each of us each year; and of course medication costs since we have a right to those—by the way, my 2015 family medication cost? $Zero).

Something stinks.

Are there any affordable health insurance plans?

Strategy #1: Get the highest deductible plan you can find + fund an HSA, FSA, or MSA + join a discount medical plan organization.

A high deductible plan paired with an HSA, FSA or MSA provides flexibility.

Created in 2003 so that individuals with high-deductible health plans (currently “high deductible” is $1,300 for self-only coverage or $2,600 for family coverage—probably most of us have “high deductible” health insurance) These accounts let us set aside “tax-preferred” dollars for medical expenses. Much like an IRA, you aren’t taxed on income that you put into these accounts.

The higher your deductible and greater your coinsurance (a percent of the total bill you pay) or copay (a fixed amount you are expected to pay regardless of the visit cost), the less you’ll pay each month in premiums. Usually you are also restricted to certain doctors who have joined the plan’s network—a number growing smaller and smaller each year as reimbursement rates dwindle.

When it is your money, you can use it on any doctor you want. You can also use it on many non-insurance-covered services (or limited ones) like acupuncture, eye exams, nutritional supplements recommended by a health care professional for a health situation (but not to maintain ordinary good health), as well as your copays/coinsurance and routine medical before you meet your deductible can all be paid with tax-preferred money; the list is here.

If you get a plan through your employer, it is usually called a “Flexible Spending Account” (FSA) or “Medical Savings Account” (MSA) and the employer usually puts some money in on your behalf. No employee plan? No problem, you can also get these through your bank—yes, that is right, your bank can set up your own personal Health Savings Account (HSA).

Preferred-tax accounts have differences, limits and rules and some company FSA’s have a shorter list of “qualified medical expenses” than those on the IRS website.

- Most FSA/MSA money is not yours—your employer often contributes a fixed or matching amounts and you use it or lose it at plan year end.

- The HSA money is yours, forever. HSA’s actually work similarly to an IRA where you can contribute up to a certain amount each year. If you don’t use that money, it grows… and grows… just like a retirement account.

- The most you can put pre-tax into an HSA in 2015 is $3,350 for an individual and $6,650 family.

- And you can’t mix and match—you can’t put money into both types of accounts the same year, but you can always use your HSA, even if you didn’t add to it in a given year.

The full IRS tax code for all these plan types is here: http://www.irs.gov/publications/p969/index.html

How to Get a Health Savings Account?

You can get a health savings account from most banks. Go into your Northrim, or Wells Fargo or Bank of America branch and just say, “I want a health savings account.” Your debit card will soon arrive in the mail and your bank normally gives you an account statement at tax time.

Strategy #2: Look into a health care sharing ministry (HCSM).

Participation in a HCSM satisfies the Affordable Care Act’s requirement that individuals purchase insurance—even though it is not technically insurance rather a group of like-minded individuals willing to care for each other when in need—even send notes of encouragement if you allow that option—to the tune of nearly half a million US citizens who belong to health share organizations. While it might seem TMI to share health situations and costs, members say it is extremely enjoyable and purposeful to help another and enjoy doing so; to “pay it forward” as a known, predictable monthly “share” that in some groups allows you to direct it to individuals with known published needs.

Participation in a HCSM satisfies the Affordable Care Act’s requirement that individuals purchase insurance—even though it is not technically insurance rather a group of like-minded individuals willing to care for each other when in need—even send notes of encouragement if you allow that option—to the tune of nearly half a million US citizens who belong to health share organizations. While it might seem TMI to share health situations and costs, members say it is extremely enjoyable and purposeful to help another and enjoy doing so; to “pay it forward” as a known, predictable monthly “share” that in some groups allows you to direct it to individuals with known published needs.

The very low cost of this non-profit arrangement is amazing—from $45/month on the low end to $480 for a family and with from $500 to $1500 annual unshared amount (like a deductible). On the possible downside, most of these groups limit the annual pay-outs from between $150,000 per member to $1,000,000. Do your homework and make sure your needs are covered.

How can they do this?

Three individuals, Congressman Tom Perriello, Virginia with Senators Max Baucus, Montana, and Charles Grassley of Iowa, put through an exemption to Obamacare that is written into the Act. This exemption permitted non-profit organizations known as health shares—where members pay a low monthly fee that goes directly to “share” medical costs of another member in need—to continue operating if they were more than ten years old.

While the ten-year rule eliminated many newer health share organizations, several organizations that were open and running successfully for over ten years were allowed to stay. These have been open for many years and have a strong history of managing payments and collecting fees over this time; some for decades. This means that they have been managed well, and will likely continue to be managed well.

How do the health share ministries keep their costs so low?

If we all could be lucky enough to be in a health care plan where everyone agreed to not smoke, drink, do drugs, avoid risky lifestyle choices and maintain healthy habits then, of course, our health insurance would be much cheaper.

And it does happen, actually quite successfully, in a medical sharing society. How? Currently, all the medical sharing societies are faith-based. Their religious philosophies include abstaining from smoking, drugs and unhealthy sexual practices, medical “incidents” do not include substance abuse and most groups expect members to seek faith-based, drug-free mental health solutions. Most of HCSMs limit medications to short-term and specifically exclude chronic, long-term medication. Members are expected to handle underlying health imbalances by making lifestyle changes and many plans offer assistance with doing so. For example, plans may require overweight or obese members to work with health coaches to correct their diet (and those costs may even be covered).

The medical sharing societies are a great fit for people who take steps to keep themselves healthy—if doing so is your personal philosophy, then you are rewarded with a low-cost and legal insurance purchasing option.

And even if you do have a medical need, these groups operate extremely efficiently: There are no middlemen; although at least one uses a preferred provider organization, they keep the paperwork low. Each group is a little different as to whether you can choose your doctor, must go through the PPO, how to submit the claim and whether they reimburse you or your doctor—but most of them pay eligible claims within weeks and in a streamlined fashion. It’s a low overhead model without layers and layers of red tape—although they each have the right to medical review of your records.

Sharing the Medical Bills Can Work!

So far, medical sharing societies have been very successful; overall the people enrolled have been keeping up with their end of the deal. This may be the answer for Americans who are ready to take charge of their health using short-term care as needed and mainly relying on maintaining a healthy lifestyle. For some, this is a better way to pay for medical costs.

Currently they are all faith-based as they rely on a good degree of group honesty and integrity. Two of these organizations require you to sign statements about your specific faith and at least one requires regular church attendance; however a fourth does not but specifies…

You qualify if you:

- Don’t use tobacco in any form

- Don’t abuse alcohol, illegal drugs or prescription drugs

- Are healthy and lead a healthy lifestyle—eat foods that nourish your body not harm it and exercise regularly

- And agree with our shared beliefs

If you are not comfortable doing this, you will not qualify for the coverage.

If this model is appealing to you, under current law you can be exempt from getting health insurance under the Affordable Care Act.

Medical Sharing Society Links

If you are interested in learning more about medical sharing societies, below are the links to the larger organizations:

Christian Health Care Ministries

Strategy #3: Join a Discount Medical Plan Organization (DMPO)

Whether you opt for a higher deductible, with or without an FSA/MSA/HSA, or join a health share society, you will want to keep your portion of the bill as low as possible. Many insurance plans and most of the health share ministries include joining a DMPO as an upgrade to their sharing levels or in the plan premiums. If not, you can join on your own at costs ranging from $49/year to $49/month.

Discount Medical Plan Organizations are not insurance; they are not a substitute for insurance.

The idea behind medical discount plans — also known as discount health care programs — is that you will save money on products and services because these organizations negotiate discounts with hundreds of thousands of healthcare providers across the U.S. While you meet your deductible, or even afterwards, you can reduce your per-visit cost which also reduces your percent coinsurance if that applies. DMPO members get substantial discounts on:

- Chiropractic Care

- Dental Care

- Vision Care

- Pharmacy

- Lab Work

- Diagnostic Imaging

- and at some Medical offices

Joining is simple, and whether you are insured, uninsured, or underinsured, your acceptance is automatic and there are no exclusions for health conditions. Because different DMPOs operate in different areas and sometimes have different specialties, like just dental for example, the best way to find one that will work for you is to ask the offices where you seek care if they offer discounts to members of any of DMPO groups. Reputable plans have a search function on their site, but this is not always updated so do your homework: check with your favorite practitioners.

Know this: by law, medical offices are allowed to have one fee for every service. They are not allowed to give random discounts or charge insurance plans more than they charge a cash-paying consumer. The only way they can legally give you more than a 15% “book-keeping” discount—for full payment at the time of service—is if you are a member of a discount plan where that medical office has contractually agreed to offer the lower price. And you usually still have to pay the discounted fee directly to the office and then self-submit the claim to any insurance you may have.

The reason most offices have you self-submit to your insurance is two-fold:

- They are actually passing along to you their administrative savings when they don’t have to bill your insurance, track your plan benefits and reimbursement rules, wait for payment, account for repricing and patient balances, send in chart notes… and all the red tape and interactions with payers that amount to about 3.8 hours a week for the typical physician—the equivalent of more than 3 workweeks a year—and require use of support staff and billing experts that eat up to half the fees charged if they aren’t first repriced (Casalino et al., 2009, also see “The Healthcare Imperative: Lowering Costs and Improving Outcomes: Workshop Series Summary“).

- Legally, the discount is due to your relationship with the discount plan and not your insurance. If you want them to bill your insurance they are actually legally obligated to bill the usual fee.

Strategy #4: Ask your favorite offices if they offer Direct-Pay Membership plans.

These are not insurance nor are they a substitute for insurance BUT they lower your costs so you get more care while you meet that $12,000+ deductible.

Born of the need to control the high cost of submitting insurance claims and restrictions bordering on telling health practitioners how to practice healthcare, more and more doctors are leaving insurance networks and setting up cash-based practices. My physical therapist client in PA was shocked to learn that only one exam is considered medically necessary and covered by most insurance plans yet the State Medical Board statutes require a re-exam within every 45 days for many situations—each Board grants medical licenses and reviews acceptable standards of care for their specialty. That insurance plan sent letters rejecting the claim and stating the PT had exceeded the care considered medically necessary—nice, since the person who gets that rejection letter is the patient.

Squeezing as many patients as possible into a day and having to be more focused on which codes will result in the highest reimbursements isn’t the kind of practice most physicians envision.

Although this model started as a “concierge practice”—a high monthly membership paid by elite clients who then were seen without making appointments and received “pre-paid” or discounted services—the model has become popular among groups seeking to provide affordable care.

Offices with Direct-Pay Membership plans usually offer of a range of primary services for a fixed, recurring, regular fee. Some practices add an enrollment fee, some keep membership fees low with per-visit fees and many also negotiate savings on labs and other diagnostics for their members. Because each plan is developed by each office based on the philosophy of care of it’s owner/practioner(s), each plan is unique.

These offices seek to establish a personal relationship and continuity of care with their members by offering the services their clients need and want in a bundle of various membership levels. This unique combination of personal relationship and consistent care results in greater satisfaction and outcomes; these plans are mutually beneficial for both the patient and the physician. Most physicians running subscription-based practices are able to spend more time with their patients because they are not mired in insurance queries and documentation requests.

For example, a Chiropractor in Monterray CA charges a $49/month automatic fee in exchange for two exams per year and a $10 copay for as many chiropractic adjustments as the doctor recommends. For those who want it, a higher monthly fee gives them $20/visit trigger point therapy and wellness counselling in addition to core chiropractic care.

And with membership, most offices also offer a slew of discounted or free-to-members online and offline wellness resources hoping to reduce the number of medical incidents by keeping you healthy.

Like the discount health plan model, members can self-submit expenses to any insurance and seek reimbursement; this saves both you and your insurance money—in fact, doctors can remain providers for certain insurance plans while still offering memberships for services that are not covered by most plans or while the deductible is being met—a win/win for everyone.